Executive Committee advances proposed 2025 Property Tax Plan to council for formal approval

A property tax plan to address the additional $8,557,515 needed to balance the city’s approved operating and capital budgets, and reserve allocations, will be considered by city council on April 28.

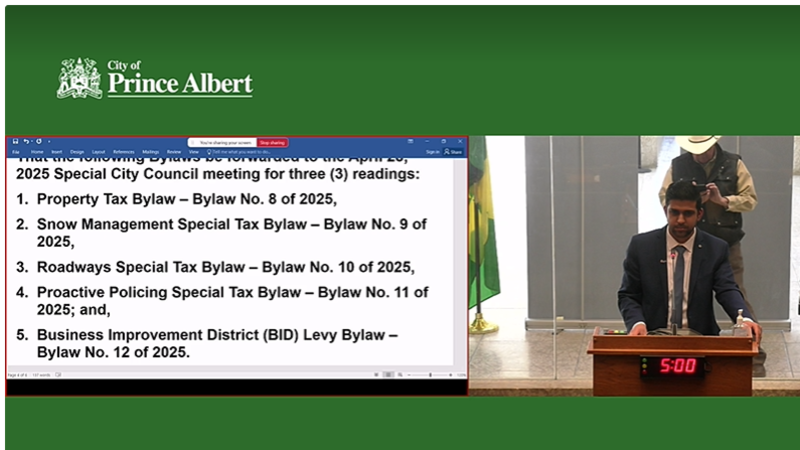

That’s when it will be up for formal approval through the property tax bylaws.

On Monday, the executive committee approved the plan to be referred to the next council meeting, however, three readings will be required before the plan is formally approved.

In addition to raising the funds required, the city’s proposed property tax plan is also designed to mitigate the effects of the 2025 revaluation on residential and commercial properties and improve the commercial-to-residential property tax ratio in the city.